Private Institutional Clients find exclusive access and opportunities

Elite success opens a world of possibility few will ever experience – and still fewer can navigate well. Helping stewards of profound wealth capitalize on success is the sole focus of the Raymond James Private Institutional Client (PIC) Solutions team. Taking an institutional approach, PIC leverages its extensive resources and capabilities to generate sophisticated and differentiated investment and capital markets-based solutions.

How we work with private institutional clients

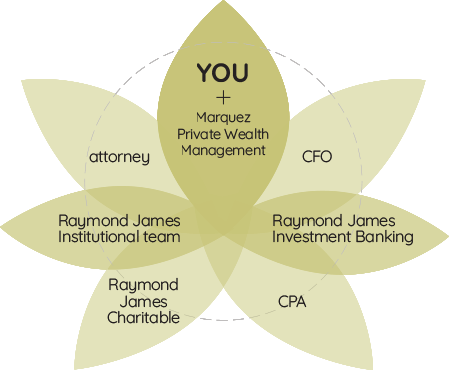

We serve as your personal manager for all your financial affairs, partnering with all your other strategic advisors.

The PIC investments platform delivers sophisticated solutions designed to address your most complex capital market and lending needs, and provide you with private market investment opportunities via institutional access to Raymond James, third-party trading desks and a variety of lending platforms.

The PIC Solutions team is dedicated to delivering bespoke investment ideas and solutions tailored to your needs, and can negotiate transactions across a wide variety of asset classes. This includes access to deals not available on typical wealth management platforms. These opportunities are presented exclusively to you and our other PIC clients, sourced across a global network of private company executives, investment bankers and fund managers.

Here at Marquez Private Wealth Management, by collaborating closely with the PIC Solutions team, we are well positioned to serve your most sophisticated needs, whether you are an ultra-high-net-worth individual, family office, endowment or other institutional account with $50 million or more in assets.

Together, you can count on us to carefully manage your investments, vigilantly preserve your significant wealth and pursue new opportunities moving forward. It’s another fitting example of how wealth truly has its privileges.

Our services include:

Private market investments:

- Co-investment opportunities

- Opportunistic direct equity investments

- Private debt syndication

- Direct real estate

- Bespoke capital stack options

Boutique funds:

- New manager seeding

- Specialized investment strategies

- Thematic opportunities

Capital markets:

- Trade idea generation and execution

- Market content and delivery

- Cross-asset-class opportunities

- Institutional pricing and service

Lending solutions:

- Asset-backed loans

- Equity margin loans and collared financing

- Cash-flow monetization

- Small- and middle-market corporations

- Commercial real estate

Raymond James Charitable is a public charity. Raymond James Trust, N.A., an affiliate of Raymond James & Associates, Inc., serves as the service provider for Raymond James Charitable.

Private Institutional Client products and services (“PIC Services”) are non-discretionary, non-fiduciary and non-advisory investment opportunities in all asset classes, conventional and alternative, that are only available to certain Alex. Brown and Raymond James clients who qualify as an “institutional account” as defined in FINRA Rule 4512(c), that are highly sophisticated investors with experience in independently evaluating and making investment decisions with respect to securities and investment strategies similar to that made available through PIC Services, which may include, without limitation: (1) arbitrage of exchange-listed securities, publicly traded corporate bonds, and structured products with an underlying correlation to market indices, volatility, dividends and longevity risk; (2) private markets investments, including, without limitation, illiquid direct investments in emerging private companies, real estate investments, and other managed alternative investments; and/or (3) structured credit and other debt instruments, including, without limitation, collateralized debt obligations (CDOs) and asset backed securities.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.